Staying Ahead with Payroll Calculation in Malaysia

Human Resource / 03 Oct 2023

Introduction

The intricate process of payroll calculation lies at the core of every business operation, ensuring that receive fair and timely compensation. For businesses in Malaysia, mastering payroll calculation is vital, not only for the satisfaction of workers but also for adherence to local regulations.

Understanding the Fundamentals of Payroll Calculation:

Before delving into intricate details, let us commence with the basics of payroll calculation. This process involves determining the appropriate remuneration for each worker based on a variety of factors, including their salary, deductions, and additional perks such as bonuses and allowances.

Components of Payroll Calculation

Payroll calculation encompasses a multi-faceted process that encompasses several distinct components:

Primary Pay

This serves as the foundation of a worker's compensation and is typically set at a fixed rate. For white-collared full-time, part-time or contract jobs, salaries are paid monthly at a fixed amount. For on-demand hourly jobs, gig workers are paid at an hourly rate, at varied cadences. For GoGet, hourly workers are paid upon job completion, three times a week.

Allowances

Employees may receive an assortment of allowances, such as housing, transportation, or meal allowances, which must be incorporated into the payroll calculation.

Deductions

For salaried employees, deductions include income tax, contributions to the Employees' Provident Fund (EPF), and contributions to the Social Security Organization (SOCSO).

For on-demand workers paid by the hour, there might be deductions like commissions to platform or agents.

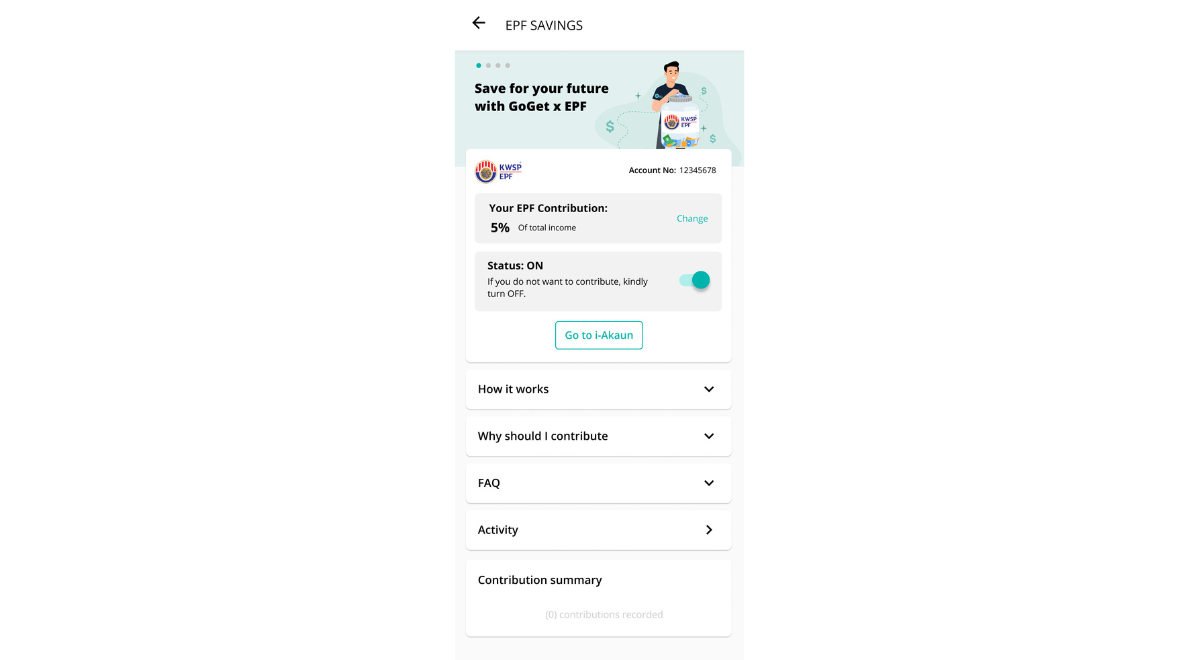

As of 2023, contributions to the Employees' Provident Fund (EPF) and the Social Security Organization (SOCSO) are compulsory for salaried employees, but not for gig workers. Gig workers like GoGetters have a choice to opt-in with GoGet to voluntarily contribute a percentage of their income into their EPF account automatically via the GoGetter app that’s integrated with EPF.

Bonuses and Overtime

Certain workers may be entitled to bonuses or compensation for overtime work, necessitating their integration into the payroll calculation.

Therefore, with so many components and variables, ensuring accurate deduction calculation in payroll is of utmost importance.

Streamlining Payroll Calculation with Software Solutions

Achieving efficient payroll management often entails the utilization of specialized software.

There are many software which cater to payroll for salaried employees. However, there are limited software options to manage payments to on-demand work like gig workers. Most businesses including big retail chains and hypermarkets are still resorting to manual payroll when it comes to hourly part timers, and maybe even cash payment that is susceptible to financial leakage.

Leveraging Technology for Efficiency in Payroll Calculation

In this digital age, technology has revolutionized the process of payroll calculation, primarily through automation, realtime access to data, and enhanced accuracy.

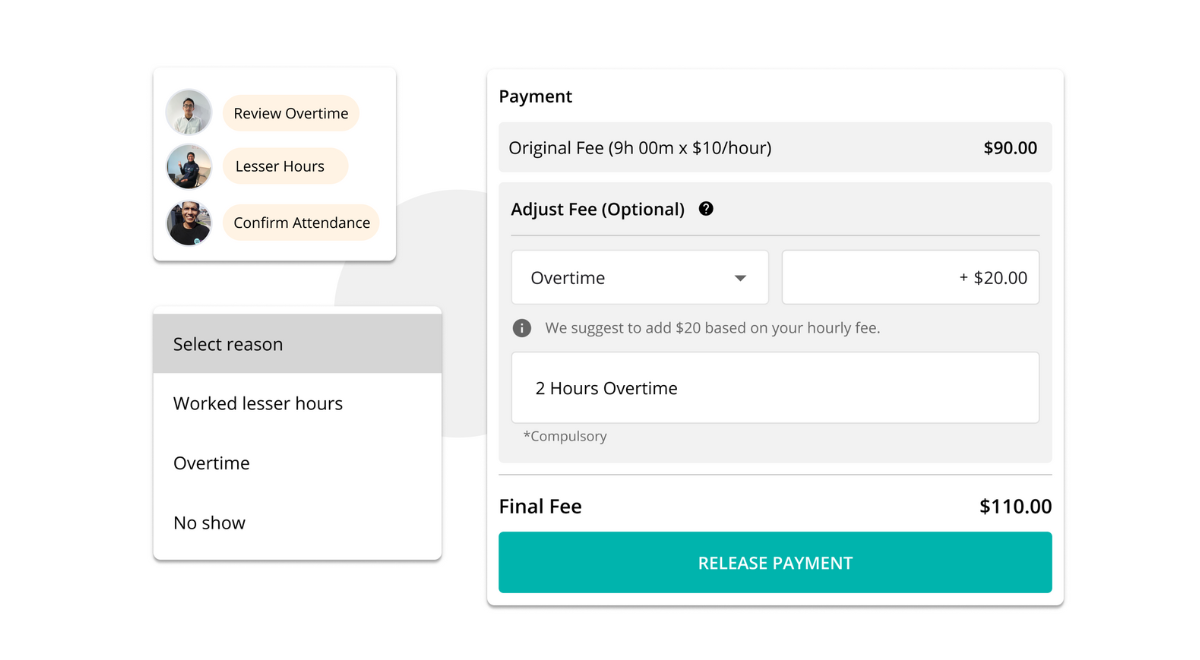

GoGet Pay possesses the capability to automate payroll calculation for work done by the hour, thereby reducing errors and conserving valuable time. It comprises 3 simple steps where HR is empowered to make decisions all entirely on the GoGet app, without paperworks.

Check: Check actual total hours worked and amount to be paid, without having to raise a dispute ticket.

Adjust: GoGet smart tech checks for clock-in and clock-out times and location, empowering HR to adjust the fee for overtime, late attendance or even partial completion of shifts.

Release: The app will auto-calculate a new total payable amount shall there be changes. HR will be given ample grace period to adjust and release payment. HR can also give tips for outstanding workers.

Conclusion

Payroll calculation and management is cornerstone to any business's HR. Staying ahead necessitates an understanding of emerging trends and technologies, to ensure compliance and a happy workforce.

Share this article